lincoln ne sales tax increase

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax.

The group is asking the City Council to place on the April 9 primary ballot a measure to raise the City sales tax one-quarter cent for six years starting October 1 2019.

. Also effective October 1 2022 the following cities. The Nebraska state sales and use tax rate is 55 055. The current state sales and use tax rate is 55 percent so the total sales and.

The City of Lincoln today reminded residents that Lincolns sales and use tax rate will increase from 15 percent t o 175 percent beginning October 1. NE Sales Tax Rate. Those dates are January 1 April 1 July 1 or October 1 of any year.

Lincolns City sales and use tax rate increase. The current state sales and use tax rate. Essex Ct Pizza Restaurants.

The December 2020 total local sales tax rate was also 7250. Lincoln The City of Lincoln will increase its local sales and use tax rate to 175 effective Oct according to a release from Nebraska Tax Commissioner Tony Fulton. A yes vote was a vote in favor of authorizing the.

025 lower than the maximum sales tax in NE. You can print a 725 sales tax table here. A sales tax measure was on the ballot for Lincoln voters in Lancaster County Nebraska on April 9 2019.

There is no applicable county tax or. Most of that money will go toward fixing up neighborhood and residential streets. A city or county sales and use tax can only start stop or change on one of four dates throughout the year.

Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15. Lincoln voters approved a limited sales tax increase Tuesday that would raise 345 million to replace the citys aging emergency radio system and build four new. The current total local sales tax rate in Lincoln NE is 7250.

In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent. Ad Calculate sales tax automatically with an Avalara plugin for the ecommerce system you use. The sales tax increase.

Spend less time on tax compliance with an Avalara AvaTax plug in for your shopping cart. Lincoln ne sales tax increase. Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to.

Lincoln Ne Sales Tax Rate Mei 15 2021. It was approved. The current state sales.

Raising the sales tax in Lincoln is expected to bring in about 13 million a year. It would also add new sales taxes of up to 825 on services essential to the well-being of Nebraskas. The City of Lincoln today reminded residents that Lincolns sales and use tax rate will increase from 15 percent to 175 percent beginning October 1.

Lincoln County NE currently has 1041 tax liens available as of February 24. In April 2015 Lincoln voters approved a 14-cent increase from 15 to 175 in the City sales and use tax to support two important public. As amended LB 289 would raise the sales tax rate to a record-high level.

NE Sales Tax Rate. In Lincoln another 15 percent or one and a half cents is added for a city sales tax which will increase to 175 percent once the quarter-cent sales tax takes effect.

Current U S Drought Monitor Drought California Drought Map

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

How To Register For A Sales Tax Permit Taxjar

General Fund Receipts Nebraska Department Of Revenue

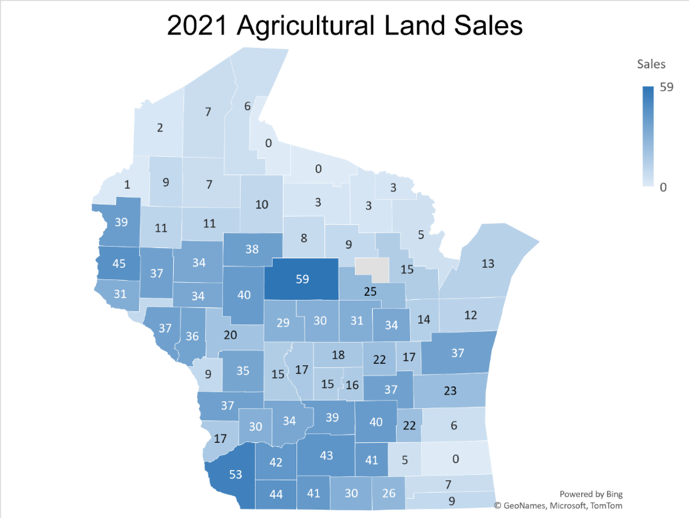

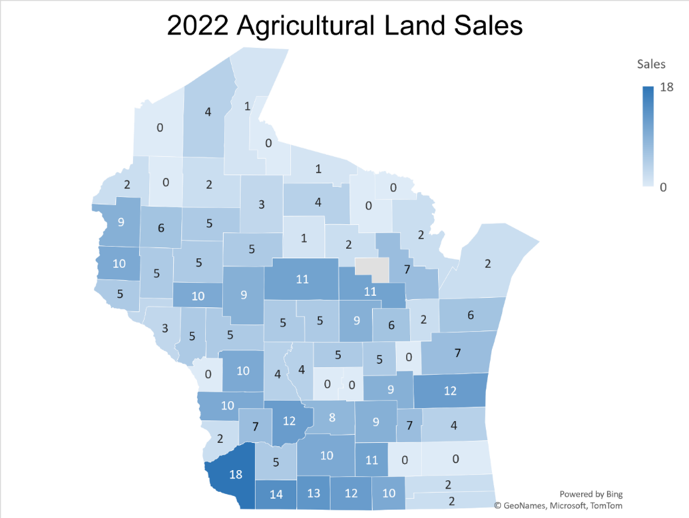

Wisconsin Agricultural Land Prices 2022 Farm Management

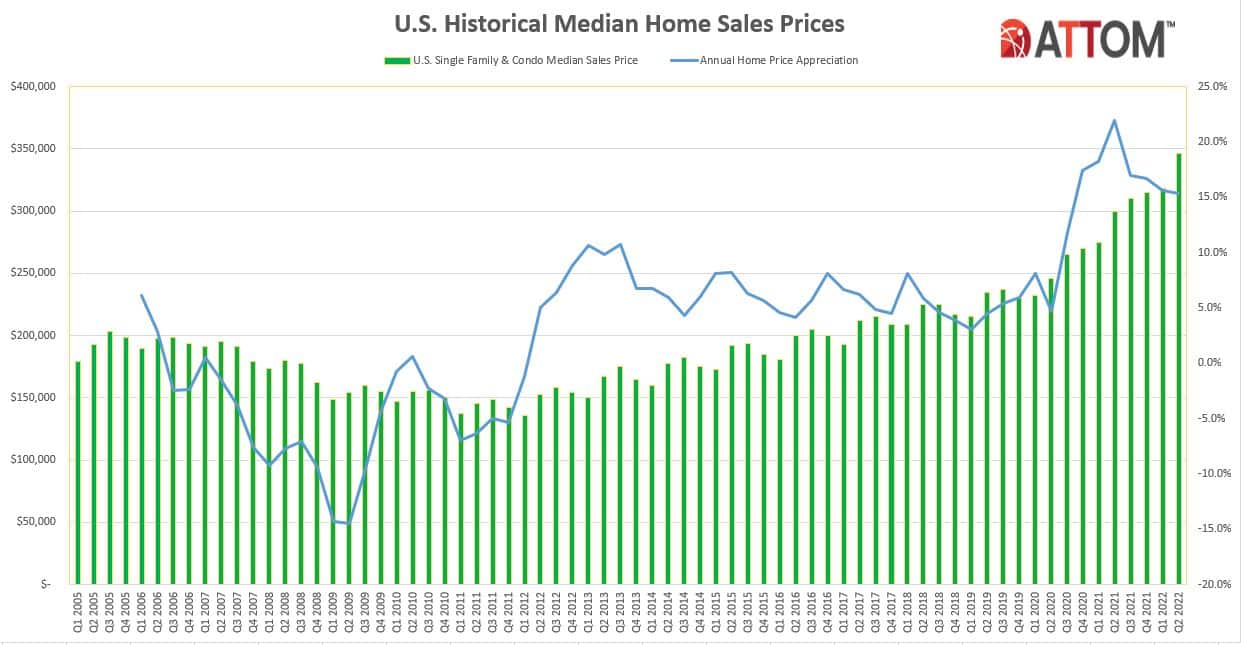

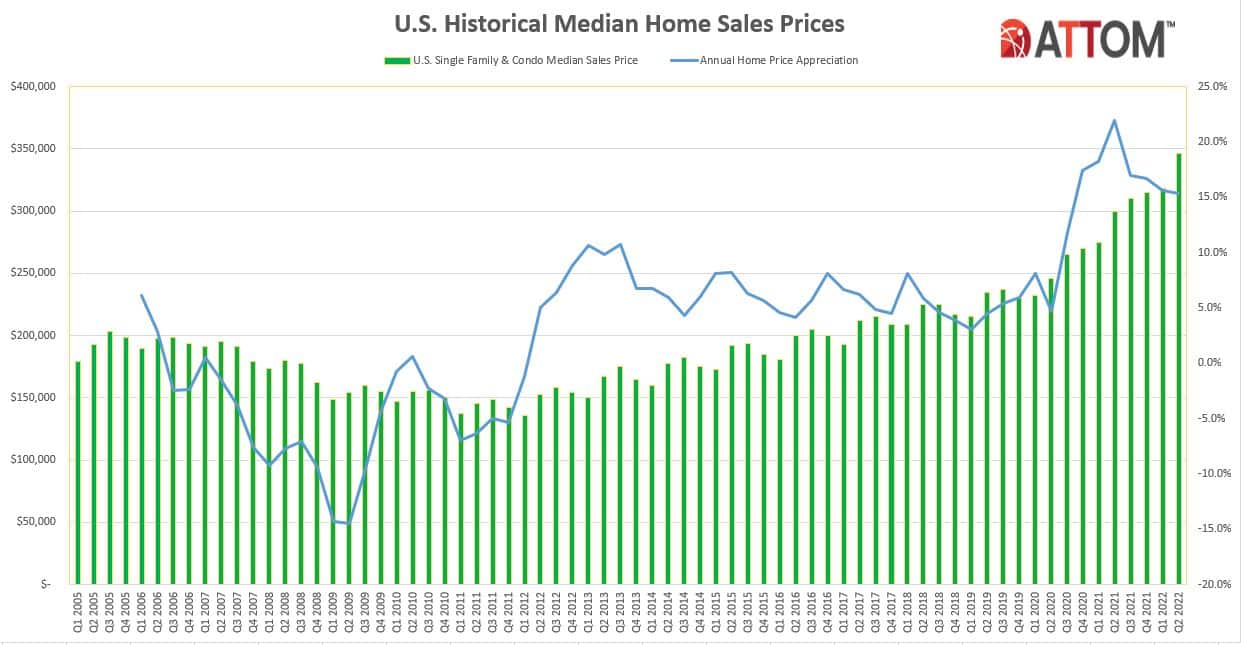

Home Seller Profits Surge Amid New Round Of Price Spikes Attom

General Fund Receipts Nebraska Department Of Revenue

Wisconsin Agricultural Land Prices 2022 Farm Management

Charles Apple Newspaper Design Layout Newspaper Design Newspaper Design Inspiration

Gross Receipts Location Code And Tax Rate Map Governments

/cloudfront-us-east-1.images.arcpublishing.com/gray/WBWSIL6OJBFSRB2ZV6ZCZEIKQI.bmp)